The exponential growth of the Battery Energy Storage System (BESS) market presents a landscape of immense opportunity fraught with commensurate risk. For Engineering, Procurement, and Construction (EPC) firms, developers, and asset owners, the ability to deliver projects on time and on budget is paramount. However, the increasing fragility and complexity of the global supply chain have rendered the traditional single-source procurement model dangerously obsolete.

This document moves beyond the superficial discussion of diversification. It presents a robust framework for implementing a BESS multi-supplier strategy not merely as a risk mitigation tactic, but as a core competitive discipline. Drawing from over a decade of direct project execution experience, this whitepaper provides a deep dive into the technical, commercial, and contractual nuances required to successfully navigate a multi-vendor environment. We will dissect integration challenges, propose quantifiable evaluation models, and share hard-won lessons from the field, referencing authoritative industry standards and data throughout.

The Imperative for a BESS Multi-Supplier Strategy: Deconstructing the Real Risks

Relying on a single supplier is an existential threat to a BESS project. The risks are not theoretical; they are tangible, quantifiable, and have become more acute in recent years. A sophisticated BESS multi-supplier strategy is the primary defense.

Deconstructing Modern BESS Supply Chain Risks

The BESS supply chain is a confluence of geopolitical, technical, and logistical vulnerabilities:

Geopolitical & Material Chokepoints: The supply chain is highly concentrated. Over 75% of lithium-ion battery manufacturing capacity resides in China, as noted in reports from the International Energy Agency (IEA). Specifically for Lithium Iron Phosphate (LFP) chemistry, which is favored for stationary storage due to its safety and cycle life, this dependency is even more pronounced. A BESS multi-supplier strategy must therefore consciously balance sourcing from this region with developing partnerships in emerging hubs like Europe and North America to mitigate tariff and trade policy risks. For Nickel Cobalt Manganese (NCM) chemistries, the dependency shifts to cobalt sourcing from regions with ESG (Environmental, Social, and Governance) concerns, adding another layer of risk.

Component & Semiconductor Bottlenecks: A BESS is more than batteries. It is a complex system of power electronics and software. The global semiconductor shortage has repeatedly demonstrated how a single missing chip for a Power Conversion System (PCS) or a Battery Management System (BMS) can halt the delivery of a multi-million-dollar system. Your primary battery supplier may have cells, but if their BMS board manufacturer is delayed, your project is delayed.

Logistical Fragility: Ocean freight volatility, port congestion, and customs delays are now permanent features of the project landscape. A fire at a single supplier’s factory or a quarantine at their primary shipping port can create a months-long domino effect.

The Quantifiable Cost of Failure: Beyond Liquidated Damages

A supply chain failure’s cost extends far beyond contractual penalties. A six-month delay on a 100 MWh BESS project can result in:

Lost Revenue & Arbitrage Opportunities: For a merchant project, this means missing months of peak energy arbitrage or ancillary service revenue (e.g., frequency regulation), potentially costing millions.

Reputational Damage: Consistently failing to meet Commercial Operation Dates (CODs) severely damages an EPC or developer’s reputation, impacting their ability to win future bids.

Increased Financing Costs: Project lenders may impose higher interest rates or stricter covenants on entities with a poor track record of on-time delivery.

Industry analysts like BloombergNEF (BNEF) have consistently highlighted that supply chain bottlenecks are a primary cause of project delays, reinforcing the urgent need for the resilient framework a BESS multi-supplier strategy provides.

Core Tenets of an Advanced Multi-Supplier Strategy

A successful strategy is built on disciplined principles. It requires moving from reactive sourcing to proactive portfolio design and quantifiable decision-making.

Tenet 1: Strategic Portfolio Design via the Tiered Risk & Value (TRV) Model

We advocate for a TRV model to structure your supplier portfolio, balancing risk, cost, and performance.

Tier 1: Bankable Behemoths: These are the top 5-10 global manufacturers with vertically integrated supply chains, massive GWh-scale production, and a balance sheet that makes them “bankable” for project financing. Role: They are the bedrock for the majority (e.g., 60-70%) of your portfolio, especially for large, utility-scale projects. They provide scale, reliability, and long-term warranty security.

Tier 2: Regional Agility Players: These are strong, reputable manufacturers within a specific geography (e.g., North America, EU). They may not have the scale of Tier 1s but offer significant advantages. Role: They are crucial for mitigating geopolitical and logistical risks. Sourcing 20-30% of your volume from them can drastically reduce shipping times, avoid tariffs, and provide faster service response.

Tier 3: Niche Technology Specialists: These are often smaller, innovative companies specializing in a particular area, such as ultra-high C-rate batteries for grid-forming applications, advanced liquid cooling systems, or next-generation BMS analytics. Role: They provide a technological edge for specific project needs, allowing you to deliver a more competitive, higher-performance solution.

Tenet 2: Quantifiable Trade-Off Analysis with a Weighted Decision Matrix

The “best” supplier is project-specific. A weighted decision matrix is an essential tool to move beyond simplistic price comparisons and make data-driven choices.

| Criteria (Weight %) | Supplier A (LFP) | Score (1-5) | Weighted Score | Supplier B (NCM) | Score (1-5) | Weighted Score |

|---|---|---|---|---|---|---|

| Cost ($/kWh, Landed) (30%) | $150 | 5 | 1.5 | $175 | 3 | 0.9 |

| Cycle Life (@80% SOH) (25%) | 8,000 cycles | 5 | 1.25 | 4,500 cycles | 3 | 0.75 |

| Lead Time (Weeks) (15%) | 30 weeks | 3 | 0.45 | 22 weeks | 5 | 0.75 |

| Warranty Terms (15%) | Strong | 4 | 0.6 | Standard | 3 | 0.45 |

| Technical Risk (Thermal) (15%) | Very Low | 5 | 0.75 | Moderate | 3 | 0.45 |

| Total Score | 4.55 | 3.3 |

In this simplified model, while Supplier B offers a faster lead time, Supplier A’s superior cost, cycle life, and safety profile make it the clear winner for a long-duration energy-shifting application. This quantitative approach is a cornerstone of an effective BESS procurement strategy.

Technical Deep Dive: The Integration and Standardization Gauntlet

A BESS multi-supplier strategy lives or dies at the point of integration. Technical incompatibility can erase all commercial benefits.

The Interoperability Gauntlet: PCS, EMS, and BMS Integration

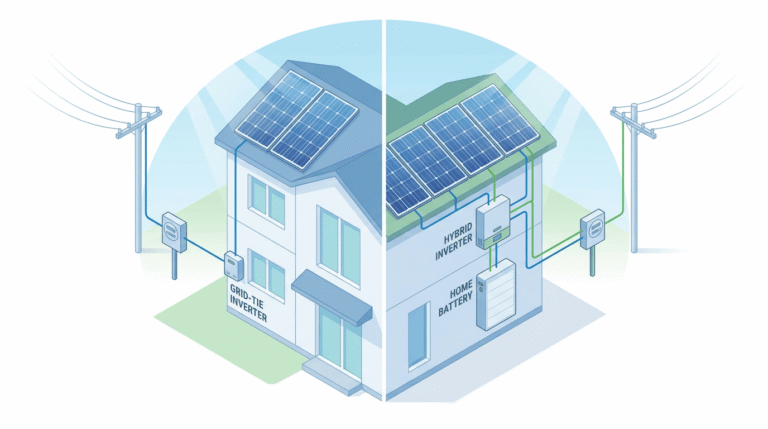

The Battery Management System (BMS) is the brain of the battery. The Power Conversion System (PCS) is the muscle. The Energy Management System (EMS) is the conductor. Getting them to communicate flawlessly across different vendors is a major challenge.

Protocol Hell: You cannot simply assume interoperability. A project may specify a PCS from a leading vendor like SMA or Power Electronics which communicates via Modbus TCP. If your Tier 1 battery supplier’s BMS is also native Modbus TCP, integration is straightforward. However, if your Tier 2 supplier’s BMS uses a CAN bus protocol, you now require a protocol gateway device and significant custom engineering to map hundreds of data points (voltages, temperatures, fault codes). In my experience, this can add weeks to commissioning and become a major point of failure.

The Power Plant Controller (PPC): For utility-scale projects, the PPC acts as the master controller, communicating with the grid operator (often via DNP3 or IEC 61850) and dispatching commands to the BESS, PCS, and other site assets. A key element of your BESS project supplier portfolio optimization is to pre-qualify battery systems based on their proven integration with your preferred PPC and PCS partners. A “plug and play” solution does not exist.

Navigating the Maze of Certifications and Codes

Compliance is non-negotiable and becomes more complex with multiple suppliers.

The System-Level Certification Challenge (UL 9540): The key safety standard for BESS in North America is UL 9540. This is a system-level certification. You cannot simply combine a UL 1973-certified battery and a UL 1741-SA-certified inverter and assume you have a UL 9540-certified system. The components must be tested together. If you introduce a battery from a new supplier into a previously certified system design, you will likely need to re-certify, which is a costly and time-consuming process involving a Nationally Recognized Testing Laboratory (NRTL).

Fire Codes and Safety (NFPA 855): The NFPA 855 standard dictates BESS installation safety, including siting, spacing, and fire protection. The results of large-scale fire testing (per UL 9540A) for each supplier’s battery system will determine the required spacing between units and the required fire suppression systems. A multi-supplier site may therefore have different safety requirements for different sections of the plant, complicating design and increasing cost. This must be evaluated before procurement.

From Theory to Practice: A Step-by-Step Implementation Framework

Step 1: Rigorous Supplier Qualification

This goes beyond a datasheet review. It must include:

On-site Factory Audits: To verify production quality, automation levels, and cell traceability.

Financial Stress Testing: Analysis of their financial health to ensure they can honor long-term warranties.

Technical Deep Dive: A multi-day workshop with their engineering team to scrutinize their BMS architecture, thermal management design, and UL 9540A test results.

Step 2: Crafting Resilient Contracts

Your contracts are your primary risk mitigation tool. They must be detailed and explicit.

Step 3: Proactive Delivery Management & Delay Response Protocol

When a delay is announced, a pre-defined Standard Operating Procedure (SOP) is critical.

Formal Notification Received: Supplier provides written notice of potential delay.

Immediate Information Request: Within 48 hours, issue a formal request for a detailed Root Cause Analysis (RCA), mitigation plan, and revised timeline.

Critical Path Analysis: Immediately assess the impact on the overall project schedule’s critical path.

Contingency Evaluation:

Can air freight for critical sub-components reduce the delay?

Can installation be re-sequenced?

Trigger Backup Supplier Clause: Notify the pre-qualified Tier 2 supplier. Request their current lead time for a contingency order.

Commercial Action: Formally reserve rights to claim LDs under the contract.

Bi-Weekly Progress Meetings: Institute mandatory, high-level meetings with the delayed supplier to track progress against their mitigation plan.

Real-World Application: A 100 MWh Project Case Study

Scenario: A 100 MWh / 200 MW BESS project in the ERCOT market (Texas) designed to provide Fast Frequency Response (FFR) and energy arbitrage. The EPC’s BESS multi-supplier strategy involved sourcing 70% of the capacity from a Tier 1 LFP supplier (for energy capacity) and 30% from a Tier 3 NCM specialist (for high C-rate power capacity needed for FFR). The PCS was from Power Electronics and the PPC from a third vendor.

The Challenge in Action: Eight months before the delivery date, the LFP supplier announced a 10-week delay on 50% of their volume due to a fire at their BMS sub-supplier’s factory. This delay threatened to push the project’s COD past the lucrative summer peak pricing season.

The Multi-Supplier Solution:

SOP Activation: The project team immediately activated the Delay Response SOP.

Contingency Order: They triggered a pre-negotiated option with their Tier 2 regional supplier in North America to produce 20 MWh of LFP systems. While the unit cost was 8% higher, the 12-week lead time was significantly shorter than waiting for the Tier 1 supplier to recover.

Integration Challenge: The regional supplier’s BMS used a CAN bus protocol. The project’s integration team worked with the PPC vendor to procure and configure a protocol gateway, adding $80,000 in cost and two weeks of commissioning time.

Result: The combination of the partial order from the Tier 1 supplier, the expedited order from the Tier 2 supplier, and the remaining NCM systems allowed the project to achieve substantial completion only three weeks behind the original schedule, capturing the majority of the summer revenue. The LDs recovered from the Tier 1 supplier partially offset the extra cost of the gateway and the premium paid to the Tier 2 supplier.

Key Lesson Learned: The “5% Integration Buffer” This project taught a critical lesson: a multi-supplier project’s budget and timeline should always include a “5% Integration Buffer.” This contingency is explicitly allocated to cover unforeseen costs and time related to resolving software, hardware, and communication incompatibilities between vendor systems.

Conclusion and Executive Recommendations

A well-executed BESS multi-supplier strategy is an intricate, resource-intensive discipline that is absolutely essential for sustainable success in the energy storage sector. It demands a fusion of deep technical expertise, commercial acumen, and rigorous project management. For leadership at EPCs, development firms, and investment funds, the mandate is clear:

Elevate Supply Chain to a C-Suite Priority: Appoint a senior executive with singular responsibility for supply chain resilience and strategy. This role is as critical as finance or engineering.

Invest in a Dedicated Vetting and Integration Team: Your organization must have in-house expertise capable of performing deep factory audits, analyzing BMS communication protocols, and managing the complex process of system integration.

Embrace Long-Term Partnerships: Move away from a purely transactional, project-by-project procurement model. Cultivate long-term, strategic relationships with your tiered suppliers. This fosters transparency and collaboration, which is invaluable during a crisis.

The era of relying on a single champion supplier is over. The future belongs to those who can master the complexity of building and managing a resilient, diversified, and strategically optimized supply chain ecosystem.