Introduction: The Paradigm Shift in Energy Storage Procurement

Table of Contents

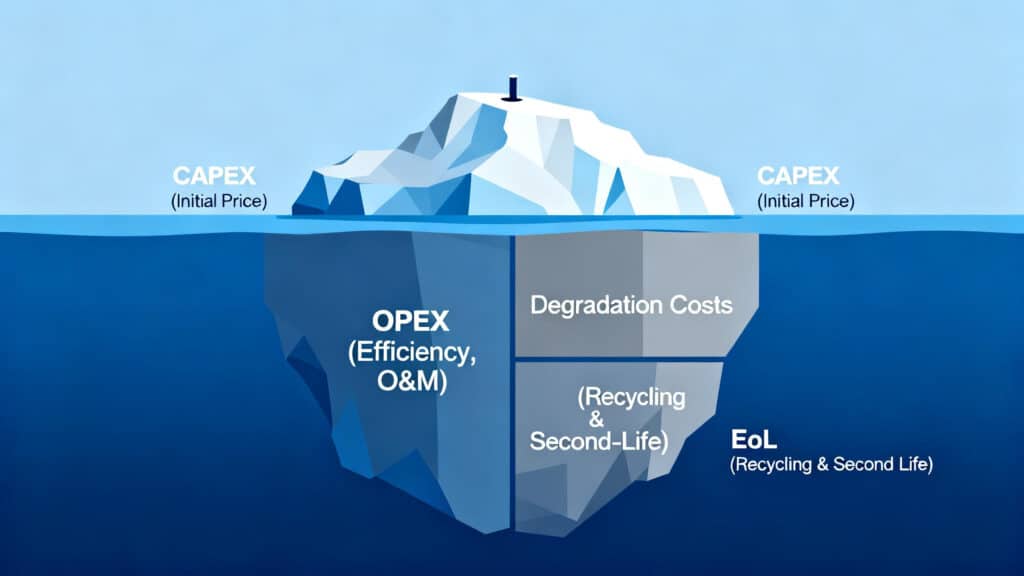

ToggleIn my two decades navigating the complexities of the new energy sector, I’ve witnessed a seismic shift in how successful businesses approach procurement. For distributors and project contractors on the front lines, the conversation is finally evolving. Why is it that in 2025, a successful energy storage battery procurement is no longer about chasing the lowest initial price tag (CAPEX)? Because the market has matured. The most profitable and reputable players now understand that the true cost of a Battery Energy Storage System (BESS) is revealed over its entire operational life, not on the initial invoice. This is the crucial concept of Total Cost of Ownership (TCO).

Focusing solely on CAPEX is a rookie mistake that can lead to catastrophic project failures, eroded margins, and damaged reputations. The real challenge, and the greatest opportunity for savvy contractors and distributors, lies in mastering a holistic BESS procurement strategy. This guide is engineered from years of hands-on experience to provide you with an actionable framework. We will dissect the TCO formula and equip you with proven strategies to optimize every variable. This is more than just a manual; it is a strategic blueprint for making your energy storage battery procurement process a powerful competitive advantage. We will explore in-depth how to reduce energy storage project TCO by transforming your approach from a simple purchasing function into a strategic value-creation engine.

Optimizing Initial Procurement Costs (CAPEX) Without Sacrificing Quality

The initial purchase price is the most visible part of the TCO iceberg. While it’s tempting to squeeze every last dollar here, a myopic focus on cost-cutting can sink the entire project. The goal is value optimization, not blind cost reduction. A strategic energy storage battery procurement process begins with a sophisticated understanding of what truly drives upfront costs.

Beyond the Cell Price: A Comprehensive Assessment of System Costs

A common pitfall in energy storage battery procurement is fixating on the price per kilowatt-hour of the battery cells alone. The cells, while critical, are just one component of a complex ecosystem. A truly professional energy storage system procurement process scrutinizes the entire Balance of System (BoS) costs.

This includes:

Power Conversion System (PCS): The quality, efficiency, and grid-forming capabilities of the PCS directly impact performance. A cheaper PCS with lower efficiency will bleed revenue every single day of operation.

Battery Management System (BMS): The BMS is the brain. A superior BMS provides more accurate State of Charge (SoC) estimation, better cell balancing, and more robust safety protocols. This extends battery life and reduces risk—a key consideration in your BESS procurement analysis.

Thermal Management (HVAC): The liquid-cooling vs. air-cooling debate is a perfect example of TCO thinking. Air cooling may offer a lower upfront cost, but liquid cooling provides superior temperature uniformity, leading to longer battery life and higher efficiency, especially in demanding climates. An effective energy storage battery procurement analysis must model these long-term operational savings.

Fire Suppression & Safety Systems: Skimping on safety is non-negotiable. Evaluating the integrated fire suppression system (e.g., gas-based like Novec 1230 or HFC-227ea, or advanced aerosol systems) is a critical step in a responsible battery energy storage procurement process.

Containerization & Integration: A lower-cost supplier might deliver components, but a Tier-1 provider delivers a pre-integrated, factory-tested solution. This significantly reduces on-site civil works, labor hours, and commissioning time, which are major—and often underestimated—cost centers for project contractors. A key goal of energy storage project procurement is to minimize on-site complexity and risk.

In my experience, a well-integrated system from a reputable manufacturer can cut on-site installation and commissioning time by 30-50%, a direct and substantial saving for any EPC contractor.

The Cornerstone of Procurement: Precision in Technical Selection

The foundation of a cost-effective energy storage battery procurement lies in choosing the right technology for the right application. Overspecifying is wasteful; underspecifying is disastrous.

Application-Driven Chemistry: For most stationary storage applications like peak shaving, grid ancillary services, and renewable energy integration, Lithium Iron Phosphate (LFP) is the undisputed champion in 2025. Its superior cycle life, enhanced safety profile, and lack of cobalt make it the most bankable choice. Nickel Manganese Cobalt (NMC) chemistries still have a role in applications requiring higher energy density, but for most commercial and industrial projects, the TCO advantage of LFP is clear. Your energy storage battery procurement process must start with this fundamental choice.

Analyzing Performance Metrics: Don’t just accept the numbers on a datasheet.

Cycle Life: A promise of “6000 cycles” is meaningless without context. Demand to see the testing conditions: Depth of Discharge (DoD), C-rate, and ambient temperature. A robust BESS procurement process involves requesting detailed degradation curves.

Energy Density: While important, it’s less critical for stationary storage than for EVs. Don’t overpay for high energy density if your project has ample physical space.

C-Rate (Power Performance): For applications like frequency regulation, a high C-rate is essential. For simple energy shifting, a lower C-rate (e.g., 0.25C or 0.5C) is sufficient and often results in a more cost-effective and longer-lasting system. A mismatch here is a classic energy storage battery procurement error.

Mastering Supplier Selection and Commercial Negotiation

Your choice of supplier is the single most important decision in the entire energy storage battery procurement journey. This is where a procurement professional earns their keep. The process for 2025 energy storage battery supplier selection must be rigorous and data-driven.

Key Supplier Vetting Criteria:

Bankability & Financial Health: Can this company honor a 10-15 year warranty? Review their financial statements, project track record, and market reputation. Tier-1 suppliers are often more “bankable,” making project financing easier to secure.

Production Capacity & Quality Control: A factory tour (virtual or physical) is indispensable. Investigate their manufacturing automation levels, quality control checkpoints (from incoming materials to final product testing), and certifications (e.g., ISO 9001, IATF 16949). A solid energy storage system procurement strategy relies on consistent product quality.

Project Experience & References: Ask for case studies and references for projects similar in size and application to your own. A supplier with a proven track record is a de-risked supplier.

Technical Support & After-Sales Service: What is their support structure in your region? What are their guaranteed response times? A cheap system with poor support will quickly become an expensive nightmare. This is a crucial element of any professional battery energy storage procurement.

Negotiation Tactics for Lowering TCO:

Move Beyond Unit Price: Negotiate the entire package. This includes training for your installation teams, extended warranties, guaranteed performance ratios, and favorable payment terms.

Volume & Framework Agreements: As a distributor or frequent contractor, leverage your potential order volume. Negotiate a Master Supply Agreement (MSA) that offers tiered pricing based on annual volume. This is a cornerstone of strategic energy storage project procurement.

Contractual Safeguards: Your purchase contract is your ultimate protection. Work with legal counsel to embed clauses covering performance guarantees, liquidated damages for delays, and specific warranty claim procedures. An effective energy storage battery procurement outcome is codified in a strong contract.

Uncovering the "Hidden Goldmine" in Operations & Maintenance (OPEX) Costs

The initial CAPEX is just the entry ticket. The real game is won or lost over the 10-20 year operational life of the asset. A forward-thinking energy storage battery procurement strategy places immense focus on minimizing OPEX, as this is where TCO can truly be optimized. The decisions you make during the procurement phase have a direct and profound impact on these long-term costs.

Round-Trip Efficiency (RTE): The Amplifier of Your LCOE

Round-Trip Efficiency is the single most critical operational metric, yet it’s often glossed over. It represents the percentage of energy you get out of a storage system relative to the amount of energy you put into it. The difference between a system with 95% RTE and one with 92% might seem small, but over a decade, the financial impact is colossal.

Let’s run the numbers for a 1MWh C&I system operating one cycle per day:

System A (95% RTE): For every 1,000 kWh injected, 950 kWh is discharged. Loss is 50 kWh.

System B (92% RTE): For every 1,000 kWh injected, 920 kWh is discharged. Loss is 80 kWh.

The difference is 30 kWh of lost energy per day. Annually, that’s 10,950 kWh. At an average electricity price of $0.15/kWh, that’s $1,642 lost per year. Over a 15-year project life, that single system will leak nearly $25,000 in revenue compared to the more efficient one. Now, multiply that across a portfolio of dozens of projects. The numbers become staggering.

During your energy storage battery procurement process, you must demand transparency on RTE.

Scrutinize Datasheets: Look for RTE figures that specify the conditions under which they were measured (e.g., state of charge, C-rate, temperature).

Request Third-Party Test Reports: Do not rely solely on the manufacturer’s claims. Reports from reputable labs like TÜV Rheinland, UL, or DNV provide unbiased validation. This due diligence is a hallmark of a professional BESS procurement approach.

Model the Financial Impact: Integrate the RTE into your project’s financial model. Show your clients or management how a slightly higher CAPEX for a more efficient system yields a significantly better long-term ROI and lower Levelized Cost of Storage (LCOE). This level of detail in an energy storage battery total cost of ownership analysis is what separates the best from the rest.

Parasitic Loads: The Unseen Cost Drain

Parasitic load, or the system’s self-consumption rate, is another OPEX black hole. This is the energy consumed by the BMS, thermal management system, and other control electronics just to keep the BESS in a ready state.

The thermal management system is often the biggest culprit. An inefficient air-conditioning (HVAC) unit on an air-cooled system can consume significantly more energy than a well-designed liquid-cooling pump and heat exchanger system, especially in warmer climates.

Your energy storage battery procurement questions for suppliers must include:

“What is the average and peak parasitic load of the containerized system in both standby and operational modes?”

“Can you provide a detailed breakdown of the power consumption for the HVAC/liquid cooling system across a range of ambient temperatures?”

These are not trivial questions. A system with a 2 kW parasitic load versus one with a 1 kW load will cost an additional 8,760 kWh, or over $1,300, per year in electricity costs just to operate. This is a direct hit to your project’s profitability, and it must be factored into your BESS procurement TCO model.

The Value of Warranty and Long-Term Service Agreements (LTSA)

A warranty is not just a piece of paper; it’s a financial instrument that protects your investment. However, not all warranties are created equal. As part of your energy storage project procurement, you need to dissect the warranty terms with a lawyer and an engineer.

Key Warranty Elements to Scrutinize:

Energy Throughput Guarantee: This is often more important than the calendar year warranty. It guarantees a certain amount of MWh can be cycled through the battery before the warranty expires.

Capacity Retention Guarantee: What is the guaranteed State of Health (SOH) at the end of the warranty period (e.g., 70% or 80%)? How is this measured?

RTE Guarantee: Some Tier-1 suppliers now offer warranties on efficiency, which is a powerful de-risking tool.

Scope of Coverage: Does the warranty cover only the defective parts, or does it include the cost of shipping, labor for replacement (the “truck roll”), and system recommissioning? These soft costs can be substantial. A thorough energy storage system procurement process clarifies these details upfront.

Beyond the standard warranty, consider a Long-Term Service Agreement (LTSA). While it adds to the initial cost, an LTSA can lock in your maintenance costs, provide guaranteed uptime, and offer preventative maintenance schedules that extend the life of your asset. For distributors and contractors, offering a project with a comprehensive LTSA from a reputable manufacturer can be a powerful selling point and a way to secure long-term service revenue. This strategic consideration is vital for any advanced battery energy storage procurement plan.

Maximizing Value at End-of-Life (EoL) by Planning Ahead

The final phase of TCO—End-of-Life—is the most frequently ignored during the procurement process, yet it holds significant potential for both cost savings and value creation. A truly comprehensive energy storage battery procurement strategy is circular; it plans for the battery’s entire journey, from cradle to grave, and ideally, to its next life. Ignoring EoL is like building a house without planning for its eventual demolition or sale—it’s short-sighted and costly.

State of Health (SOH) and Its Impact on Residual Value

The residual value of your BESS at the end of its primary application life is directly tied to its remaining State of Health (SOH). A battery system that degrades gracefully to 70% SOH after 15 years is far more valuable than one that plummets to 60% in the same timeframe.

What determines this graceful degradation?

Inherent Cell Quality: This goes back to Phase 1. Choosing a Tier-1 supplier with superior cell chemistry and manufacturing consistency is the first step to ensuring a higher residual value. This is a prime example of how a smart energy storage battery procurement decision pays dividends a decade later.

Excellence of the BMS: A sophisticated BMS with precise cell monitoring and balancing prevents individual cells from over-stressing, leading to more uniform degradation across the entire pack. During your BESS procurement diligence, ask deep questions about the BMS’s algorithms and control strategies.

Effectiveness of Thermal Management: As discussed, maintaining a stable and uniform internal temperature is critical to slowing degradation. This reinforces why evaluating the thermal management system is a vital part of the energy storage system procurement process.

A higher SOH means a higher potential resale value on the secondary market or a more capable asset for a second-life application.

The Second-Life Opportunity: From Liability to Asset

When a battery is no longer suitable for a demanding grid-scale or C&I application, it’s not “dead.” It can be repurposed for less demanding roles, a practice known as second-life or cascade use. This is a cornerstone of the circular economy and a key element in a forward-thinking battery energy storage procurement strategy.

Potential second-life applications include:

Residential energy storage

Backup power for telecom towers

Community solar + storage projects

EV charging station buffers

To capitalize on this, your energy storage battery procurement process must favor systems designed for disassembly and repurposing. Look for modular designs where individual battery packs can be easily tested, removed, and reconfigured. A system with a detailed data history for each module, managed by the BMS, is exponentially more valuable for second-life applications because it allows for accurate SOH assessment.

Compliant Disposal Costs and ESG Benefits

If second-life is not an option, the battery must be recycled. The costs associated with the transportation and recycling of lithium-ion batteries are significant and regulated. A haphazard energy storage project procurement plan that ignores this will leave the project owner with a substantial and unexpected bill at the end of the project’s life.

During procurement, ask potential suppliers about their end-of-life programs:

Do they offer a take-back or recycling program?

Are their batteries designed for easier disassembly to facilitate material recovery?

Can they provide a clear estimate of future recycling costs?

Furthermore, incorporating a clear EoL plan into your projects has powerful ESG (Environmental, Social, and Governance) benefits. For your clients, particularly large corporations, demonstrating a responsible and circular approach to energy storage battery procurement can be a significant factor in their decision-making process, aligning with their corporate sustainability goals. This is no longer a “nice-to-have”; it is a competitive differentiator.

A Practical TCO Framework for Distributors and Contractors

Theory is useful, but execution is everything. As a distributor or project contractor, you need a practical way to implement these TCO principles. This is where your role evolves from a simple reseller to a trusted value-added partner. This section serves as a concise commercial & industrial energy storage procurement guide.

Strategy 1: Build a TCO Costing Model

You cannot manage what you do not measure. Develop a standardized TCO calculation spreadsheet for your team. This model should be a critical tool in your energy storage battery procurement process, allowing you to compare supplier proposals on an apples-to-apples basis over the project lifetime.

Your model should include inputs for:

CAPEX: System hardware, shipping, installation, commissioning.

OPEX: Round-trip efficiency losses, parasitic loads, annual maintenance costs, warranty costs, and potential replacement parts.

EoL: Estimated recycling costs (as a negative value) or projected resale/second-life value (as a positive value).

When you present a proposal to a client, don’t just show them the upfront price. Show them the 15-year TCO. This immediately elevates the conversation from price to value and positions you as a sophisticated expert. This detailed energy storage battery total cost of ownership analysis becomes your most powerful sales tool.

Strategy 2: Develop Deep In-House Procurement Expertise

Your procurement team needs to be bilingual—fluent in the language of commerce and the language of engineering. A successful energy storage battery procurement professional must be able to read a technical datasheet and understand its long-term financial implications.

Invest in Training: Send your procurement and sales teams to technical training sessions on BESS technology.

Foster Collaboration: Create a seamless workflow between your engineering and procurement departments. The technical due diligence on a supplier should be as rigorous as the commercial negotiation.

Stay Informed: The energy storage market is evolving at lightning speed. Your team must stay current on new technologies, evolving safety standards (like UL 9540A), and market price trends to execute an effective BESS procurement strategy.

Strategy 3: Cultivate Strategic Supplier Partnerships

In this industry, you don’t want a long list of suppliers; you want a short list of true partners. Move away from a transactional battery energy storage procurement approach to a relational one.

Identify two to three Tier-1 suppliers who align with your business on quality, support, and strategic vision. By committing volume to these partners, you can achieve:

Better Pricing: Volume discounts are just the beginning.

Enhanced Support: You become a priority customer, receiving faster response times and dedicated technical support.

Product Roadmap Influence: True partners will give you a preview of their upcoming products, allowing you to prepare your sales channels.

Streamlined Processes: Working with the same few suppliers simplifies everything from training your installers to managing inventory and warranty claims. This operational efficiency is a hidden but significant benefit of a focused energy storage project procurement strategy.

Conclusion: Redefining Procurement as a Value Center

As we move firmly into 2025, the energy storage landscape will be dominated by those who master the art and science of TCO. For distributors, wholesalers, and EPC contractors, the message is clear: the most effective way to secure your profitability and build a sustainable business is to evolve your energy storage battery procurement process. It must transform from a back-office cost center into a strategic, forward-looking value center.

The journey from a CAPEX-focused mindset to a TCO-driven strategy requires diligence, expertise, and a commitment to long-term thinking. It means asking tougher questions, building smarter financial models, and choosing partners over mere suppliers. By implementing the frameworks outlined in this guide—optimizing CAPEX without compromising quality, aggressively managing OPEX, and planning for end-of-life value—you will not only master how to reduce energy storage project TCO, but you will also build a more resilient, profitable, and reputable business. The future of energy storage battery procurement is not about buying cheaper; it’s about buying smarter. Make that your competitive edge.