The global energy landscape is undergoing a monumental transformation, driven by the urgent need to decarbonize and the rapid proliferation of renewable energy sources like solar and wind. However, the intermittent nature of these sources presents a significant challenge to grid stability. This is where the energy storage market steps in, acting as the critical linchpin for a reliable, resilient, and green electricity grid. The demand for energy storage batteries is surging globally, but this demand is far from uniform. Understanding the geographical distribution of the energy storage market demand is paramount for manufacturers, investors, policymakers, and procurement specialists aiming to navigate this complex and rapidly expanding sector. Different regions exhibit unique market dynamics, shaped by a confluence of regulatory frameworks, economic incentives, grid infrastructure maturity, and renewable energy penetration. This analysis delves into the geographical nuances of the energy storage market, providing a comprehensive overview of current trends, key regional drivers, and a future outlook, offering strategic insights for stakeholders across the value chain. As the world accelerates its energy transition, a granular understanding of regional demand for energy storage solutions is no longer just an advantage—it is a necessity for success.

Global Energy Storage Market Overview

The global energy storage market is experiencing a period of explosive market growth. What was once a niche segment is now a mainstream pillar of the energy transition. According to recent industry analyses, the market is projected to expand exponentially in the coming years. A report from the International Energy Agency (IEA) highlights that global energy storage capacity is set to increase dramatically, with projections showing deployments reaching hundreds of gigawatts (GW) annually by 2030 Source: IEA, Batteries and Secure Energy Transitions. This surge in storage battery demand is fueled by several interconnected factors.

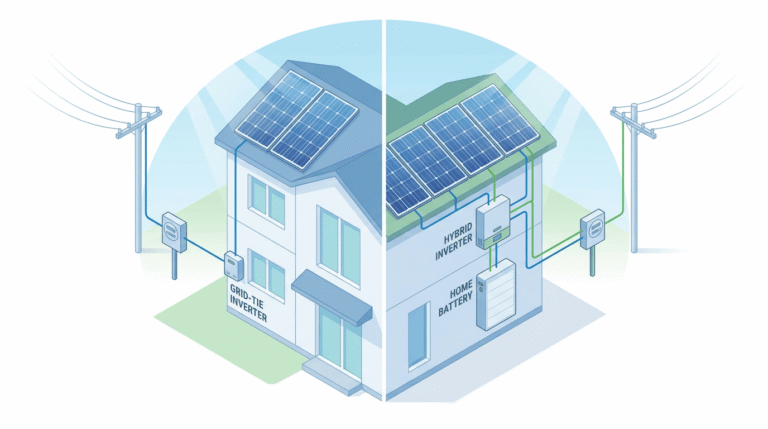

First and foremost is the global push towards renewable energy. As countries strive to meet their climate targets under the Paris Agreement, the installation of solar and wind capacity has skyrocketed. Energy storage batteries are essential to manage the variability of these resources, storing excess energy during periods of high generation and dispatching it during periods of low generation or high demand. Second, supportive government policies and financial incentives have been instrumental in de-risking investments and stimulating market growth. From tax credits and subsidies to favorable market regulations, governments worldwide are recognizing the indispensable role of the energy storage market. Third, the continuous decline in the cost of energy storage batteries, particularly lithium-ion technology, has made these energy storage solutions economically viable for a wider range of applications, from large-scale grid services to residential use. The convergence of these drivers has created a fertile ground for the expansion of the global energy storage market, with demand diversifying across utility-scale, commercial & industrial (C&I), and residential sectors.

Key Regional Markets for Energy Storage Batteries

The global energy storage demand is concentrated in a few key regions, each with its own distinct market characteristics and growth trajectory. While North America, Europe, and the Asia-Pacific region currently dominate the landscape, emerging markets in Latin America and Africa are poised for significant growth. Analyzing the regional energy storage demand reveals how local policies, grid needs, and economic conditions shape the adoption of energy storage solutions.

A comparative analysis shows that the Asia-Pacific region, led by China, is the largest energy storage market by installed capacity and is also the fastest-growing. North America, driven by the United States, follows closely, with a strong focus on utility-scale projects. Europe’s market growth is propelled by ambitious renewable energy targets and a robust residential storage sector, particularly in Germany. Understanding these regional differences is crucial for developing effective market-entry and expansion strategies. For example, a focus on grid-scale, long-duration storage might be successful in the US, whereas a strategy centered on residential and C&I solutions could be more effective in parts of Europe. Let’s explore these key regional markets in greater detail.

North America: A Leading Market for Energy Storage Batteries

North America, and particularly the United States, stands as a powerhouse in the global energy storage market. The region’s demand is driven by a combination of progressive state-level policies, federal incentives, and an urgent need to modernize aging grid infrastructure. The US energy storage market has witnessed record-breaking installations year after year, with utility-scale storage accounting for the largest share of this market growth.

The single most significant catalyst for the energy storage demand in North America has been the Inflation Reduction Act (IRA) of 2022. This landmark legislation introduced a standalone Investment Tax Credit (ITC) for energy storage solutions, allowing projects to receive a 30% or higher tax credit without needing to be co-located with a solar generation facility. This policy shift has unlocked a torrent of investment into the energy storage market, making standalone storage economically competitive and accelerating project development nationwide Source: U.S. Department of Energy, Inflation Reduction Act Guidebook.

States like California, Texas, and Arizona are at the forefront of this expansion. California has long been a leader, with ambitious renewable portfolio standards (RPS) and specific energy storage procurement mandates designed to ensure grid reliability as fossil fuel plants are retired. Texas, with its unique ERCOT market and high penetration of wind and solar, has become a hotbed for energy storage batteries that provide critical ancillary services and capitalize on price arbitrage opportunities. The regional demand in these areas is primarily for large-scale lithium-ion battery systems that can provide capacity, frequency regulation, and other grid services. As renewable energy penetration continues to grow, the need for these energy storage solutions will only intensify.

Europe: Policy-Driven Demand for Energy Storage Solutions

The energy storage market in Europe is fundamentally shaped by strong, top-down policy initiatives aimed at achieving climate neutrality and energy independence. The European Union’s Green Deal and the REPowerEU plan have set ambitious targets for renewable energy deployment, creating a massive and sustained demand for energy storage solutions to ensure grid stability and security. The continent’s market growth is a direct response to these clear and long-term policy signals.

The REPowerEU plan, formulated in response to geopolitical instability and the need to reduce reliance on imported fossil fuels, has further accelerated the European energy storage trajectory. The plan emphasizes the rapid scale-up of renewables, which in turn necessitates a parallel scale-up of energy storage capacity to manage grid congestion and ensure a stable supply Source: European Commission, REPowerEU Plan. This has spurred investment in a wide array of storage technology adoption, from grid-scale batteries to behind-the-meter systems.

Germany is a standout leader within the European energy storage market, boasting the largest residential storage market in the world. High electricity prices, coupled with feed-in tariff reductions and strong government support for solar-plus-storage systems, have incentivized homeowners to invest in energy storage batteries. The United Kingdom is another key market, with a sophisticated ancillary services market that provides multiple revenue streams for grid-scale battery projects. Other countries like Italy, Spain, and France are also experiencing rapid market growth, driven by their own national energy and climate plans. The demand across Europe is diverse, spanning utility-scale projects that support the transmission grid and a thriving C&I and residential sector focused on self-consumption and energy cost management.

Asia-Pacific: High Growth Potential in Energy Storage

The Asia-Pacific (APAC) region is the undisputed engine of the global energy storage market. Its sheer scale, rapid economic growth, and massive investments in renewable energy have positioned it as the largest and fastest-growing market for energy storage batteries. The energy storage demand in Asia-Pacific is led by China, which is installing storage capacity at a breathtaking pace, but other countries like Australia, Japan, South Korea, and India are also significant contributors to the region’s dynamic market growth.

The China energy storage story is one of immense scale and ambition. Driven by national policies mandating the co-location of storage with new renewable energy projects, China is deploying gigawatts of storage capacity to support its world-leading solar and wind installations. The country’s dominant position in the global battery manufacturing supply chain also gives it a significant cost advantage, further fueling the domestic energy storage market.

Australia has emerged as another key market, particularly in the residential sector. With the highest per-capita solar penetration in the world, many Australian homeowners are adopting energy storage solutions to maximize their solar self-consumption and gain resilience against grid outages. At the utility-scale, large battery projects like the Hornsdale Power Reserve have demonstrated the critical role that energy storage batteries can play in stabilizing grids with high levels of renewables. Meanwhile, India is a growth market with enormous potential. The Indian government has set ambitious renewable energy targets, and as the grid struggles to keep pace, the need for regional demand for energy storage to improve power quality and reliability is becoming increasingly acute. Across APAC, the primary drivers are supporting massive renewable energy build-outs and enhancing grid stability, creating a vast and varied landscape of opportunities for the energy storage market.

Emerging Markets: Energy Storage Demand in Latin America and Africa

While North America, Europe, and Asia-Pacific currently dominate the headlines, the emerging markets of Latin America and Africa represent the next frontier for the energy storage market. These regions face unique energy challenges, including unreliable grids, limited energy access in rural areas, and an abundance of untapped renewable resources. Energy storage solutions are uniquely positioned to address these challenges, offering a pathway to a more resilient and decentralized energy future.

The Latin America energy storage market is beginning to gain traction, with countries like Chile, Brazil, and Mexico leading the way. Chile, with its excellent solar resources in the Atacama Desert, is deploying large-scale solar-plus-storage projects to provide consistent power and reduce its reliance on fossil fuels. Brazil is exploring the use of energy storage batteries to improve grid stability and integrate its significant hydropower and growing wind and solar capacity.

The Africa energy storage narrative is largely centered on improving energy access and reliability. For millions of people living in areas with weak or non-existent grids, microgrids and off-grid systems powered by solar and supported by energy storage batteries offer a life-changing solution. A report by the World Bank emphasizes the role of decentralized energy solutions in achieving universal energy access in Sub-Saharan Africa Source: World Bank, Mini Grids for Half a Billion People. While these markets face significant headwinds, including financing hurdles and a lack of clear regulatory frameworks, the underlying demand for reliable power creates a compelling long-term opportunity. The market growth in these regions will likely be driven by smaller, decentralized projects and microgrids, representing a different but equally important segment of the global energy storage demand.

Key Drivers Influencing Energy Storage Market Demand Globally

The phenomenal market growth of the energy storage market is not happening in a vacuum. It is being propelled by a set of powerful, mutually reinforcing drivers that are reshaping energy systems worldwide. Understanding these key energy storage drivers is essential to appreciating the market’s current trajectory and future potential.

First, policy support and regulatory frameworks are the most critical enablers. Financial incentives like tax credits, direct subsidies, and grants reduce the upfront cost of energy storage batteries and improve project economics. Market-based mechanisms, such as allowing storage to participate in wholesale electricity markets (e.g., for frequency regulation or capacity), create predictable revenue streams that attract investment. Furthermore, ambitious renewable energy mandates and decarbonization targets set by governments create a guaranteed, long-term regional demand for the flexibility that energy storage solutions provide.

Second, relentless technology development and cost reduction have been game-changers. The cost of lithium-ion batteries has fallen by over 85% in the past decade, making energy storage economically competitive with conventional grid assets like peaker gas plants Source: BloombergNEF, Lithium-Ion Battery Price Survey. Ongoing innovation in battery chemistry (e.g., LFP, sodium-ion) and manufacturing processes continues to drive down costs and improve performance, including safety and lifespan. This technological progress is expanding the addressable market for energy storage batteries across all segments.

Finally, diversifying market needs are creating new applications and revenue streams. The rise of electric vehicles (EVs) is creating a synergy with the stationary storage market, with potential for vehicle-to-grid (V2G) applications. Businesses are increasingly adopting energy storage solutions to reduce their electricity costs, improve power quality, and ensure business continuity during grid outages. Homeowners are seeking energy independence and resilience. This diversification of demand ensures that the energy storage market growth is robust and not reliant on a single application.

Future Outlook for Energy Storage Market Demand by Region

Looking ahead, the future energy storage market is poised for continued and accelerated growth, but the pace and nature of this growth will vary significantly by region. The regional demand forecast indicates that while the established markets will continue to expand, emerging economies will play an increasingly important role in the global picture.

The Asia-Pacific region is expected to remain the largest energy storage market for the foreseeable future, driven by the sheer scale of China’s renewable energy and storage deployment plans. The country’s focus on building a resilient “new-type power system” will sustain massive regional demand. India and Southeast Asian nations are also expected to see exponential market growth as they grapple with integrating their own ambitious renewable energy targets.

In North America, the IRA will continue to be a primary driver, fostering a stable and predictable investment environment for the US energy storage market. The focus will likely expand from short-duration lithium-ion batteries to long-duration energy storage (LDES) technologies needed to support a grid with very high levels of renewable penetration.

The energy storage market in Europe will continue its policy-driven expansion. The drive for strategic autonomy in clean energy technologies will likely spur the development of a local battery manufacturing supply chain, potentially reducing costs and further stimulating demand. The residential and C&I segments are expected to remain strong, complemented by a growing need for grid-scale storage to support cross-border energy trading.

The most significant long-term potential lies in the emerging markets of Latin America, Africa, and the Middle East. As these regions work to modernize their grids and expand energy access, energy storage solutions will be a cornerstone of their energy infrastructure development. While facing challenges, the opportunity to leapfrog traditional centralized grid models with decentralized, renewable-powered systems presents a massive opportunity for the energy storage market.

Conclusion: Strategic Insights for Energy Storage Suppliers

The geographical distribution of the energy storage market demand presents both challenges and immense opportunities for suppliers, from battery cell manufacturers to system integrators. A one-size-fits-all approach is destined to fail. Success in this dynamic global market requires a nuanced, regionally-focused strategy grounded in a deep understanding of local drivers, policies, and customer needs.

For suppliers targeting the energy storage market, market optimization begins with product alignment. In North America, the demand for large, utility-scale systems necessitates robust, long-lasting energy storage batteries (often LFP chemistry) and sophisticated software for market participation. In contrast, the German market requires compact, highly efficient, and safe residential energy storage solutions. Understanding these regional demand insights is the first step.

Furthermore, navigating complex supply chains and local content requirements is crucial. The IRA in the US and potential policies in Europe favor local manufacturing. Suppliers who can establish a regional presence, either through direct investment or strategic partnerships, will have a significant competitive advantage. Building relationships with local developers, utilities, and regulators is equally important to gain insights and build trust.

Finally, suppliers must adapt their business models. In mature markets, this might mean offering sophisticated financing solutions or performance guarantees. In emerging markets, the focus might be on providing turnkey, containerized energy storage solutions that are easy to deploy in remote locations. By tailoring their products, supply chains, and go-to-market strategies to the specific demands of each geographical region, suppliers can effectively capture a share of the burgeoning global energy storage market and play a vital role in enabling the clean energy transition.