As a seasoned engineer and procurement specialist who has navigated the complexities of the global new energy sector for over a decade, I’ve witnessed market shifts and technological evolutions firsthand. Today, no region presents a more compelling narrative of urgent need and explosive potential than Latin America. The burgeoning Latin America energy storage battery demand across this continent is not merely a trend; it is a fundamental pillar of its ongoing energy transition. Driven by the aggressive adoption of renewable energy sources and underpinned by increasingly supportive government policies, Latin America is rapidly transforming from a peripheral player into a central hub for energy storage innovation and investment.

This analysis provides an in-depth perspective on the critical factors fueling the energy storage battery demand in Latin America’s key emerging markets. We will dissect the market landscape, explore country-specific drivers, address the tangible challenges on the ground, and identify strategic opportunities for investors, developers, and supply chain partners looking to capitalize on this significant growth trajectory. The core keywords we will focus on are energy storage battery demand, the Latin American storage market, energy transition, and renewable energy integration.

An Overview of the Latin American Energy Storage Battery Market

From a procurement and project development standpoint, understanding the macro environment is paramount. The Latin American energy storage market is characterized by a powerful combination of necessity-driven demand and proactive policy-making, creating a fertile ground for growth.

Market Size and Growth Trajectory

The data paints a clear picture of acceleration. According to leading market intelligence firms like BloombergNEF, the Latin American energy storage market has consistently posted double-digit annual growth. Projections indicate this is set to continue, with the region expected to add multiple gigawatts of storage capacity within the next five years. This expansion is not speculative; it’s a direct response to the massive influx of variable renewable energy (VRE) onto the grid. Countries such as Brazil, Mexico, Chile, and Colombia are at the forefront, launching ambitious utility-scale projects and creating frameworks for distributed energy resources. The increasing energy storage battery demand is a direct reflection of the region’s commitment to modernizing its energy infrastructure and ensuring a stable, decarbonized power supply. This rapid escalation in Latin America’s storage needs is positioning it as a globally significant emerging market for energy storage technologies.

Policy Support and Government Initiatives

Government action is the critical catalyst unlocking this market’s potential. Across the continent, policymakers are recognizing that renewable energy targets are unattainable without corresponding investments in energy storage. These are not just high-level goals; they are being translated into tangible policies. For instance, Chile’s ambitious energy transition plan, which aims for a carbon-neutral economy, explicitly relies on large-scale energy storage to manage the intermittency of its world-class solar and wind resources. As detailed by the Chilean Ministry of Energy, these policies include competitive auctions that often favor or mandate co-located storage, as well as regulatory reforms to properly compensate storage assets for the grid services they provide. This type of government support is crucial as it de-risks investment and creates a clear, long-term market signal, directly stimulating the energy storage battery demand.

Primary Market Drivers

Two fundamental forces are at the heart of this market expansion:

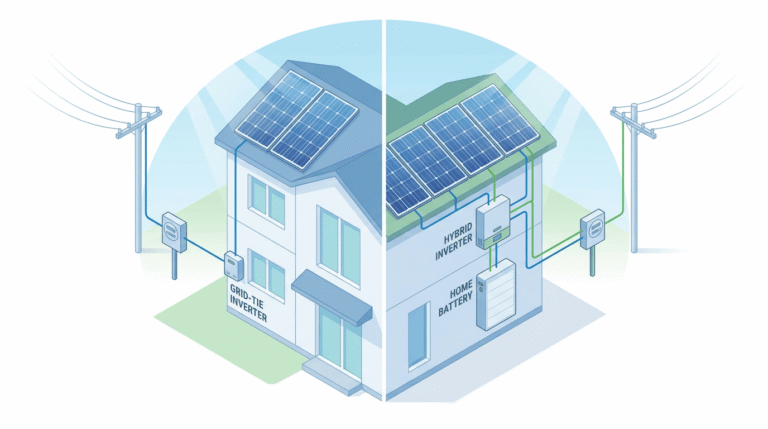

The Proliferation of Renewable Energy: Latin America is blessed with some of the world’s best solar and wind resources. As the cost of photovoltaic (PV) and wind turbine technology has plummeted, deployment has soared. However, this success has created a new challenge: grid instability. The intermittent nature of solar and wind power—generating electricity only when the sun shines or the wind blows—can wreak havoc on grid frequency and voltage. Battery Energy Storage Systems (BESS) are the premier technical solution to this problem, absorbing excess generation during sunny and windy periods and discharging it during periods of low generation or high demand. This essential grid-balancing function is the single largest factor driving the utility-scale energy storage battery demand.

Modernization of the Electrical Grid: Much of Latin America’s transmission and distribution (T&D) infrastructure is aging or insufficient to handle the bidirectional power flows and dynamic loads of a modern, decentralized grid. In many cases, particularly in remote or geographically challenging areas, deploying battery storage is faster and more cost-effective than building new transmission lines—a concept known as a “non-wires alternative.” Furthermore, for industrial and commercial consumers plagued by poor power quality or high peak demand charges, behind-the-meter battery storage offers a compelling economic case for resilience and cost savings. This need for grid modernization and power reliability is a significant secondary driver of the overall energy storage battery demand.

Country-Specific Analysis of Latin America Energy Storage Battery Demand

To truly grasp the opportunity, we must move from a regional overview to a country-specific analysis. The nuances of each nation’s energy matrix, regulatory environment, and economic priorities define the unique contours of its market.

Brazil: From Hydropower Dependence to a Diversified Grid

As Latin America’s largest economy, Brazil’s energy landscape is dominated by hydropower. While a renewable source, this heavy reliance creates significant vulnerability to climate change-induced droughts, as seen in recent years. To mitigate this risk and diversify its energy mix, Brazil is aggressively pursuing solar and wind power. This strategic shift has created an urgent need for energy storage. BESS is viewed as a critical technology to ensure grid stability as the contribution from variable renewables grows and to provide a reliable power source when hydroelectric reservoirs are low.

The Brazilian government, through its Energy Research Office (EPE – Empresa de Pesquisa Energética), has outlined long-term plans that implicitly require a massive build-out of energy storage. While specific mandates are still evolving, industry projections based on renewable integration targets suggest Brazil will need to add tens of gigawatts of storage capacity by 2030 to support its decarbonization goals. The energy storage battery demand in Brazil is driven by both utility-scale grid support and a rapidly growing distributed generation market where C&I clients seek to optimize their energy costs.

Mexico: Unleashing Solar Potential

Mexico possesses some of the highest solar irradiance levels in the world, giving it enormous potential for solar power generation. The country has established a national goal of generating 35% of its electricity from clean energy sources. Achieving this target is technically and economically unfeasible without a significant deployment of energy storage. Batteries are essential to smooth the output of large-scale solar farms, shift solar energy production from midday to the evening peak demand hours, and provide ancillary services to maintain grid stability.

While regulatory changes have created some market uncertainty in recent years, the underlying economic and technical fundamentals remain strong. The trend of nearshoring—multinational companies moving their manufacturing to Mexico—is further increasing the demand for high-quality, reliable electricity. This industrial growth, coupled with the renewable energy mandate, underpins a vast and largely untapped market, ensuring that the long-term energy storage battery demand in Mexico will continue its upward trajectory.

Chile: The Global Bellwether for Renewable Integration

Chile is arguably the most advanced energy storage market in Latin America and a global leader in navigating the challenges of high VRE penetration. The country’s Atacama Desert provides an unparalleled solar resource, leading to a massive build-out of solar PV. This has created a severe “duck curve” issue, where abundant, cheap solar power during the day causes wholesale electricity prices to crash, sometimes to zero or negative, while prices soar in the evening after the sun sets.

This extreme price volatility creates a powerful economic incentive for energy storage. The government has responded with a clear and supportive policy framework, including a recent law that promotes storage by allowing standalone systems to participate in the wholesale electricity market and receive payments for both energy and capacity. As outlined in its long-term energy plans, Chile aims for a significant portion of its electricity to come from renewables well before 2035, a goal that is entirely dependent on the large-scale deployment of BESS. For any company in the energy storage sector, Chile represents a mature, well-defined market where the energy storage battery demand is immediate, well-understood, and supported by robust regulation.

Colombia: The Push for Resilience and Diversification

Similar to Brazil, Colombia’s electricity system is predominantly based on hydropower. This makes it susceptible to climatic patterns like the El Niño phenomenon, which can lead to severe droughts and strain the power grid. To enhance energy security and diversify its generation mix, the Colombian government is actively promoting non-conventional renewable energy sources, particularly solar and wind.

Recognizing the crucial role of storage in this transition, the Ministry of Mines and Energy (Ministerio de Minas y Energía) has established specific goals and launched auctions for renewable energy projects that include storage components. The government aims for a substantial increase in energy storage capacity by 2028, with a particular focus on improving grid reliability in remote and off-grid communities. In these areas, battery storage paired with solar PV provides a cleaner, more reliable, and often cheaper alternative to diesel generators. This dual focus on both utility-scale grid support and distributed energy access creates a multi-faceted and rapidly growing energy storage battery demand in Colombia.

Primary Challenges in the Latin American Energy Storage Battery Market

Despite the immense potential, deploying energy storage projects in Latin America is not without its challenges. As a procurement specialist, it is my job to identify and mitigate these risks.

Lagging Infrastructure Development

While the demand for BESS is surging, the supporting infrastructure often struggles to keep pace. In many regions, the transmission grid is congested and lacks the modern control systems needed to optimally integrate and dispatch storage assets. Permitting processes can be slow and complex, varying significantly from one country to another. For projects in remote locations, logistical challenges related to transportation and site access can add significant cost and time. Overcoming these infrastructure hurdles requires deep local knowledge and strong partnerships, and they remain a key constraint on the pace of deployment, even as the underlying energy storage battery demand grows.

Capital and Technology Gaps

Energy storage projects are capital-intensive. Although battery costs have fallen dramatically, a large-scale BESS still represents a significant upfront investment. Accessing competitive financing in some Latin American markets can be challenging due to perceived political or currency risks. According to analysis from institutions like the World Bank and the International Energy Agency (IEA), while capital is available globally for green projects, mobilizing it effectively at the local level requires stable regulatory frameworks and bankable offtake agreements.

Furthermore, while the core technology is mature, there remains a skills gap in the region for the highly specialized engineering, construction, and operation of advanced BESS. This necessitates a focus on training and knowledge transfer to ensure the long-term performance and reliability of these critical assets.

Future Outlook and Investment Opportunities

The future for the Latin American energy storage market is exceptionally bright. The challenges, while significant, are being actively addressed, and the fundamental drivers are strengthening.

Market Growth Projections

The confluence of falling battery costs, rising renewable energy penetration, and supportive government policies is creating a perfect storm for market liftoff. Conservative estimates project that the installed energy storage battery demand will lead to a market of over 1,500 MW annually by 2025, with some forecasts suggesting a multi-gigawatt annual market before the end of the decade. Brazil, Mexico, Chile, and Colombia will undoubtedly lead this charge, but other countries like Peru and Argentina are also showing promising signs of market development. This sustained, high-growth environment makes Latin America one of the most attractive regions globally for energy storage investment.

Analysis of Investment Opportunities

The opportunities span the entire value chain:

Project Development and Ownership: For investors and independent power producers (IPPs), developing and owning utility-scale BESS projects, either standalone or co-located with renewables, offers long-term, stable returns, often backed by government auctions or corporate power purchase agreements (PPAs).

Technology and Equipment Supply: For manufacturers of batteries, inverters, and control systems, Latin America represents a massive new market. The energy storage battery demand will require a robust and competitive supply chain. Companies that can establish a local presence and navigate the region’s import and logistics complexities will have a distinct advantage.

Engineering, Procurement, and Construction (EPC): As the number and scale of projects increase, so will the need for experienced EPC contractors who can deliver high-quality, reliable BESS projects on time and on budget.

Software and Grid Services: The value of a battery is maximized through intelligent software that can optimize its dispatch for multiple revenue streams (e.g., energy arbitrage, frequency regulation, capacity payments). Companies providing these advanced software and control platforms will be critical enablers of the market.

Conclusion and Strategic Recommendations

In conclusion, the Latin American energy storage market is at an inflection point. The immense need for grid flexibility, driven by the unstoppable growth of renewable energy, has created a structural, long-term, and rapidly growing energy storage battery demand. While navigating the complexities of infrastructure, financing, and regulation requires expertise and diligence, the opportunities for companies across the value chain are undeniable. The confluence of rich natural resources, political will, and economic necessity has set the stage for a decade of transformative growth.

For new energy enterprises and investors looking to enter or expand in this dynamic market, I offer the following strategic recommendations:

Prioritize Local Partnerships: The regulatory and business landscapes of Latin America are diverse and complex. Partnering with established local developers, legal firms, and EPC contractors is essential for navigating permitting, securing financing, and managing project execution.

Develop Regulatory Expertise: Closely monitor the evolving policy landscape in target countries. Engage with policymakers and industry associations to advocate for clear and stable regulations that properly value the services provided by energy storage.

Innovate Financing Models: Explore creative financing structures, such as public-private partnerships, green bonds, and blended finance mechanisms that involve development banks, to mitigate risk and reduce the cost of capital.

Adapt Technology to Local Conditions: Latin America’s diverse geography and climate demand a tailored approach to technology selection. As an engineer, I cannot overstate the importance of choosing battery chemistries, thermal management systems, and enclosure designs that are optimized for local conditions, whether it’s the high altitudes of the Andes, the humidity of the Amazon, or the extreme heat of the Atacama Desert.

By adopting a strategic, well-informed, and locally sensitive approach, stakeholders can successfully overcome the challenges and unlock the immense value embedded within Latin America’s energy transition, a transition where the demand for energy storage batteries is not just a component, but the cornerstone of success.